What does the ownership structure of SomnoMed Limited (ASX: SOM) look like?

The large groups of shareholders of SomnoMed Limited (ASX:SOM) have power over the company. Institutions often own shares in more established companies, while it is not uncommon to see insiders owning a good number of smaller companies. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, “Don’t tell me what you think, tell me what you have in your wallet”.

SomnoMed is a small company with a market capitalization of A$173 million, so it may still fly under the radar of many institutional investors. Looking at our ownership group data (below), it appears that institutions own shares in the company. Let’s dig deeper into each owner type to learn more about SomnoMed.

Discover our latest analysis for SomnoMed

What does institutional ownership tell us about SomnoMed?

Institutional investors typically compare their own returns to the returns of a commonly tracked index. They therefore generally consider buying larger companies that are included in the relevant benchmark.

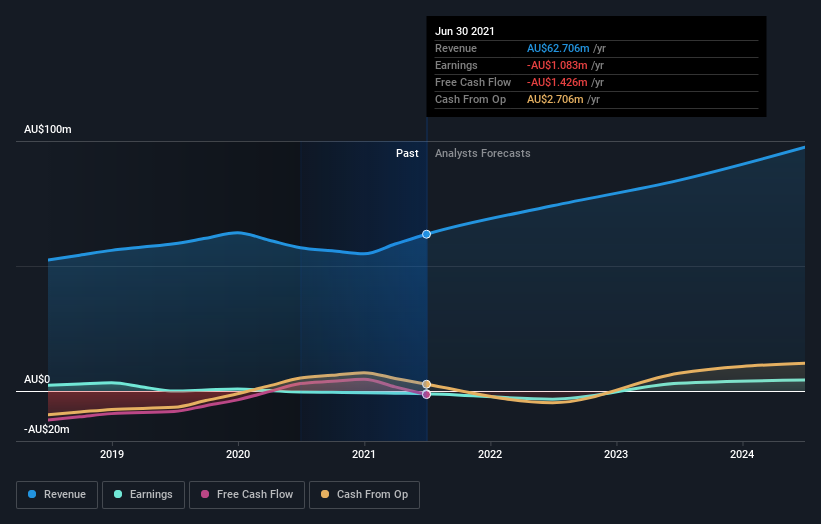

As you can see, institutional investors hold a significant share of SomnoMed. This may indicate that the company has some degree of credibility in the investment community. However, it is best to be wary of relying on the so-called validation that accompanies institutional investors. They are also sometimes wrong. When multiple institutions hold a stock, there is always a risk that they are in a “crowded trade”. When such a transaction goes wrong, multiple parties may compete to quickly sell shares. This risk is higher in a company with no history of growth. You can see SomnoMed’s revenue and historical revenue below, but keep in mind there’s always more to tell.

SomnoMed does not belong to hedge funds. Our data shows that TDM Growth Partners is the largest shareholder with 27% of shares outstanding. Meanwhile, the second and third largest shareholders hold 11% and 7.9% of the outstanding shares respectively. Additionally, the company’s CEO, Neil Verdal-Austin, directly owns 2.1% of the total shares outstanding.

Our research also shed light on the fact that approximately 53% of the company is controlled by the 4 major shareholders, suggesting that these owners wield significant influence over the company.

Institutional ownership research is a good way to assess and filter the expected performance of a stock. The same can be obtained by studying the feelings of the analyst. There is some analyst coverage of the stock, but it could still become better known over time.

Insider Property of SomnoMed

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The management of the company answers to the board of directors and the latter must represent the interests of the shareholders. In particular, sometimes the senior executives themselves sit on the board of directors.

I generally consider insider ownership to be a good thing. However, there are times when it is more difficult for other shareholders to hold the board accountable for decisions.

Shareholders would probably be interested to learn that insiders hold shares of SomnoMed Limited. In their own name, insiders hold A$14 million worth of shares in the A$173 million company. This shows at least some alignment, but we generally like to see larger insider holdings. You can click here to see if these insiders have been buying or selling.

General public property

The general public, generally individual investors, holds 16% of SomnoMed’s capital. This size of ownership, although considerable, may not be sufficient to change company policy if the decision is not in line with other large shareholders.

Private equity ownership

With a 27% stake, private equity firms are able to play a role in shaping corporate strategy with a focus on value creation. This might appeal to some, because private equity is sometimes an activist who holds management accountable. But other times, the private equity sells off, after taking the company public.

Private Company Ownership

We can see that private companies hold 18% of the issued shares. It might be worth exploring this further. If related parties, such as insiders, have an interest in any of these private companies, this should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Ownership of a public company

It appears to us that public companies hold 5.6% of SomnoMed. It’s hard to say for sure, but it suggests they have intertwined business interests. This could be a strategic stake, so it’s worth monitoring this space for ownership changes.

Next steps:

It is always useful to think about the different groups that own shares in a company. But to better understand SomnoMed, we need to consider many other factors. Consider the risks, for example. Every business has them, and we’ve spotted 1 warning sign for SomnoMed you should know.

But finally it’s the future, not the past, which will determine the performance of the owners of this company. Therefore, we think it’s advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: The figures in this article are calculated using trailing twelve month data, which refers to the 12 month period ending on the last day of the month in which the financial statements are dated. This may not be consistent with the annual report figures for the full year.

Feedback on this article? Concerned about content? Get in touch with us directly. You can also email the editorial team (at) Simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts only using unbiased methodology and our articles are not intended to be financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. Our goal is to bring you targeted long-term analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price-sensitive companies or qualitative materials. Simply Wall St has no position in the stocks mentioned.

Comments are closed.